TABLE OF CONTENTS

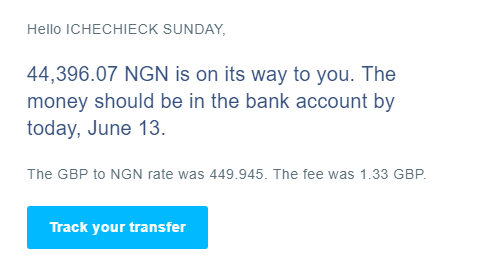

Payoneer exchange rate in Nigeria is N360/$. And you can withdraw from Payoneer to your Nigerian bank at slightly below CBN rate with transferwise.

Join us on Telegram and be the first to know when rich content as this drops on the internet:

Please register on Transferwise with my affiliate link and chat me up on Telegram @FaithNT for help anytime you have challenges, and I will always be willing to help.

Take a look at some of the screenshot below, and let me know if your exchanger offer you such Payoneer exchange rate in Nigeria.

You can also read

Steps to withdrawing Payoneer Nigeria funds to your Nigerian Bank Account

- Signup on Payoneer: if you already have a Payoneer account, you can disregard this step, and move on to the next step. (always register with my link, I earn some little referral income with it).

- Signup on Transferwise: Very important is that you should signup with my link :). Once you have signup with my link, you should complete the verification process. After verification, you should use the following steps.

How to withdraw Payoneer funds with transferwise

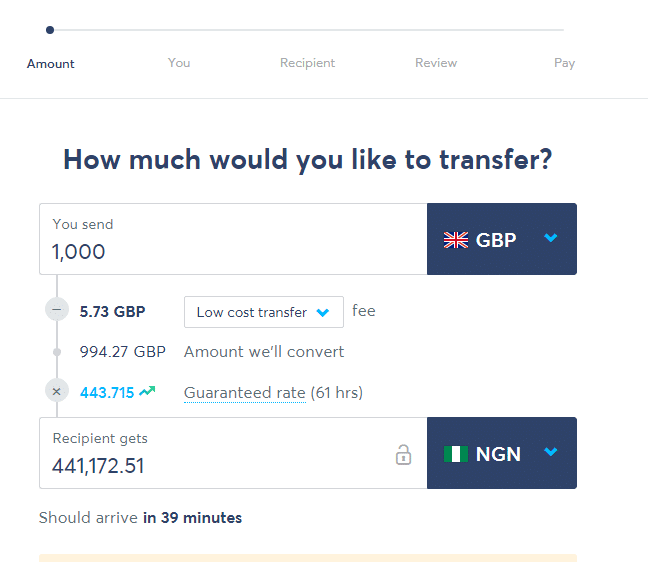

Step 1: Send Funds

Things you should note while going over this process is thus:

- You should only use the send button and not add money button

- You should always try with a small amount like $20 before withdrawing your funds – assuming you have enough funds.

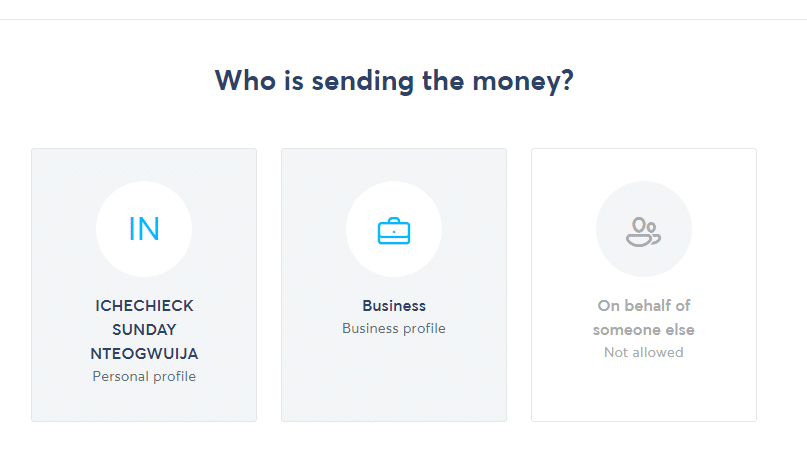

Step 2: Who is Sending the Money

You should make it very clear to them who is sending the money as anything unclear to Transferwise will make them disable your account.

You should let them know you are the one sending the money. As you can see in the screenshot below, it’s me sending to myself.

You should fill all the details correctly and move on to the next step.

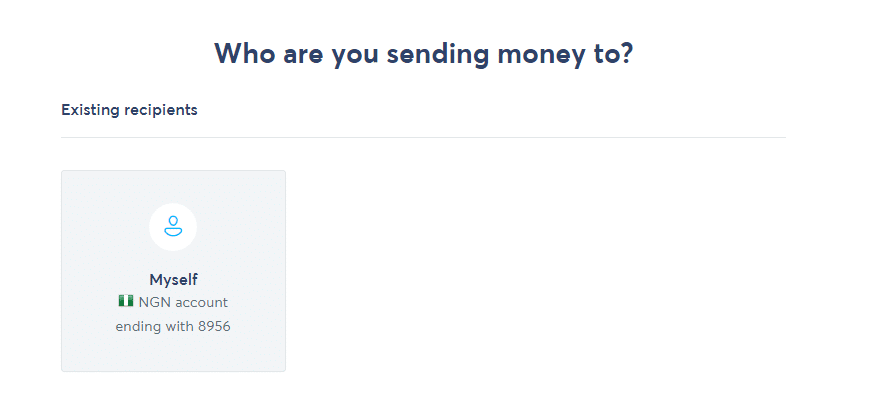

Step 3: Specify the Recipient

Here, you should input your personal account details. It doesn’t have to be a domiciliary account or anything similar but a local account you use on a daily basis.

Once that is done, you should also cross-check and ensure there is no error. Any error whatsoever could cause them to disable your account without reason.

Step 4: Review Your Account

This step will summarise the entire process from step one and two above. And it will show you your bank details, the sender and the receiver. Once you click that it’s ok, you will be redirected to put your funding source.

Step 5: Pay

This is the last process of getting your Payoneer funds into your Nigerian bank in minutes.

At this stage, you have to choose your funding source. Whether it’s a credit card or debit card.

For Payoneer, it’s a debit card, and you will have to input the card details – just like you purchase things online.

Your card will be debited the same amount as specified in step one and in few minutes you should get your money in your Nigerian bank account.

The end. Payoneer exchange rate in Nigeria remains a relative question with relative answer. While you may have seen that it’s NGN360/$ in the blurb, and something slightly different from your withdrawal is affirmative to volatility in foreign/local currency exchange.

You can also read:

- How to open a paypal account in Nigeria that sends and receives fund

- How to withdraw from paypal in Nigeria